HP’s Budget Review

This Budget certainly featured many announcements aimed at encouraging hiring, investment and spending. The Government’s task now is to encourage businesses and households to take advantage of the new programs to deliver stronger economic growth and more jobs. We’ve pulled together the pieces we think will be of most interest to you.

Personal

The Government has announced that it will bring forward changes to the personal income tax rates that were due to apply from 1 July 2022, so that these changes now apply from 1 July 2020 (i.e., from the 2021 income year). This means millions of Australians will have more money in their wallets potentially from the end of October.

These changes involve:

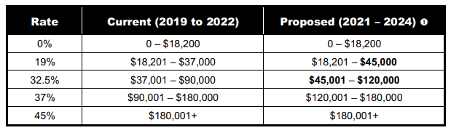

increasing the upper threshold of the 19% personal income tax bracket from $37,000 to $45,000; and

increasing the upper threshold of the 32.5% personal income tax bracket from $90,000 to $120,000.

These changes are illustrated in the following table (which excludes the Medicare Levy).

The Government announced that it will also bring forward the changes that were proposed to the LITO (low income tax offset) from 1 July 2022, so that they will now apply from 1 July 2020 (i.e., from the 2021 income year), as follows:

The maximum LITO will be increased from $445 to $700.

The increased (maximum) LITO will be reduced at a rate of 5 cents per dollar, for taxable incomes between $37,500 and $45,000.

The LITO will be reduced at a rate of 1.5 cents per dollar, for taxable incomes between $45,000 and $66,667.

First Home Buyer Scheme

The first home buyer scheme has been expanded to allow an additional 10,000 first home buyers to obtain a loan to build or buy a newly built home with a deposit of as little as 5 percent. The Government has also increased the cap to up to $950,000 (from $750,000).

Small Business

Extension of the Instant Asset Write-Off

An extension of this program out to June 2022 to allow businesses to immediately depreciate eligible assets, with no cap on the value of these assets. This not only directly benefits small businesses that invest but some of these assets will be purchased from or serviced by other small businesses.

The Government has announced it will introduce the following changes to the Capital Allowance provisions:

(a) Businesses with an aggregated annual turnover of less than $5 billion will be able to claim an immediate deduction (what the Budget terms as ‘full expensing’) for the full (uncapped) cost of an eligible depreciable asset, in the year the asset is first used or is installed ready for use, where the following requirements are satisfied:

The asset was acquired from 7:30pm AEDT on 6 October 2020 (i.e., Budget night).

The asset was first used or installed ready for use by 30 June 2022.

The asset is a new depreciable asset or is the cost of an improvement to an existing eligible asset, unless the taxpayer qualifies as a small or medium sized business (i.e., for these purposes, a business with an aggregated annual turnover of less than $50 million), in which case the asset can be second-hand.

(b) As is currently legislated, businesses with aggregated annual turnover between $50 million and $500 million can still deduct the cost of eligible second-hand assets costing less than $150,000 that are purchased from 2 April 2019 and first used or installed ready for use between 12 March 2020 and 31 December 2020 under the enhanced instant asset write-off. The Government has announced that it will extend the period in which such assets must first be used or installed ready for use by 6 months, until 30 June 2021.

(c) Small businesses (i.e., with aggregated annual turnover of less than $10 million) can deduct the balance of their simplified depreciation pool at the end of the income year while full expensing applies (i.e., up to 30 June 2022).

Furthermore, the provisions which prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended.

R&D Tax Incentive

For small companies (annual turnover of less than $20 million) the refundable R&D tax offset will be set at 18.5 percentage points above the claimant’s company tax rate and there will be no cap on annual cash refunds.

Loss Carry-Back Provisions

Companies (with turnover of less than $5 Billion will be able to offset losses incurred to June 2022 against prior profits made in or after the 2018/19 financial year.

Job Creation Announcements

JobMaker Hiring Credit

A 12-month wage subsidy for businesses that hire 16 to 35 year olds for at least 20 hours per week, who were on JobSeeker. It will be a $200/week subsidy for those under 30 and $100/week for those aged 30-35. It’s expected that employers will report JobMaker Hiring Credits using Single Touch Payroll.To be an ‘eligible employee’, the employee must:

be aged (i.e., at the time their employment started) either:

16 to 29 years old, to attract the payment of $200 per week; or

30 to 35 years old to attract the payment of $100 per week;

have worked at least 20 paid hours per week on average for the full weeks they were employed over the reporting period;

have commenced their employment during the period from 7 October 2020 to 6 October 2021;

have received the JobSeeker Payment, Youth Allowance (Other), or Parenting Payment for at least one month within the past three months before they were hired; and

be in their first year of employment with this employer and must be employed for the period that the employer is claiming for them.

Apprentice Wage Subsidy Scheme

In addition to the $1b set aside for JobTrainer in the middle of the year and the existing $2.8b Supporting Apprentices and Trainees wage subsidy, the Government has committed an additional $1.2b to pay half the wage for any new apprentice hired from 5 October 2020. The funding will go towards up to 100,000 positions (up to $28,000 a year) and is open to any employer hiring an apprentice regardless of location, occupation, industry or business size.

Other Budget Announcements

Superannuation

The Government will provide $159.6 million over four years from 2020/21 to implement reforms to improve outcomes for superannuation fund members.

Commencing 1 July 2021, the Your Future, Your Super package will improve the superannuation system by:

Having your superannuation follow you.

Making it easier to choose a better fund with a new interactive online YourSuper comparison tool.

Holding funds to account for underperformance.

Increasing transparency and accountability.

Main Residence Exemptions for certain granny-flat arrangements

The main residence exemption will be made available to granny flats used by older Australians and those with a disability. Due to concerns regarding Elder Abuse, this relief will only be available where there is a formal written occupancy agreement in place. This measure will commence in the tax year after the measure has received Royal Assent. Whilst not specifically stated in the measure, it is understood that the owner of the property would be a family member of the occupant.