Budget Wrap 22/23

On Tuesday, 29 March 2022, Treasurer Josh Frydenberg handed down the 2022-23 Federal Budget, his fourth Budget. The Treasurer detailed the current state of the economy, a plan to help Australia move past a difficult two-year period following the COVID-19 pandemic and a number or measures to improve cost of living pressures.

We’ve tried to pull out what we think you might be interested in and here’s our breakdown.

Personal

Increase to low and middle income tax offset (‘LMITO’)

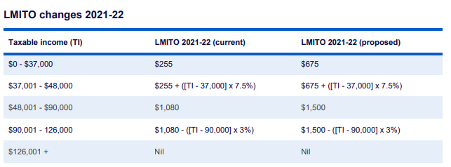

The Government has announced a once-off $420 ‘cost of living tax offset’ for the 2022 income year, which will be provided in the form of an increase to the existing LMITO. This will increase the maximum LMITO benefit to $1,500 for individuals and $3,000 for couples, and will be paid from 1 July 2022 when Australians submit their tax returns for the 2022 income year.

Other than those who do not require the full offset to reduce their tax liability to zero, all LMITO recipients will benefit from the full $420 increase. All other features of the LMITO remain unchanged. To the extent an individual is entitled to an amount of LMITO for the 2022 income year under the current law, their entitlement is proposed to be increased by $420, as follows:

Increasing the Medicare levy low-income thresholds

The Government will increase the Medicare levy low-income thresholds for seniors and pensioners, families and singles from 1 July 2021 as follows:

The threshold for singles will be increased from $23,226 to $23,365.

The family threshold will be increased from $39,167 to $39,402.

For single seniors and pensioners, the threshold will be increased from $36,705 to $36,925.

The family threshold for seniors and pensioners will be increased from $51,094 to $51,401.

For each dependent child or student, the family income thresholds will increase by a further $3,619 instead of the previous amount of $3,597.

Tax deductibility of COVID-19 test expenses

The Government will ensure that the costs of taking a COVID-19 test to attend a place of work are tax deductible for individuals from 1 July 2021. In making these costs tax deductible, the Government will also ensure FBT will not be incurred by businesses where COVID-19 tests are provided to employees for this purpose.

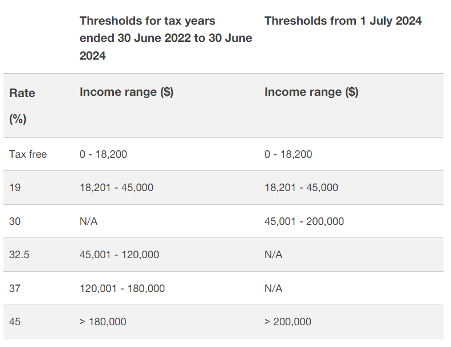

No changes to the personal tax rates for 2022-23

The Stage 3 personal income tax cuts remain unchanged and will commence in 2024-25 as already legislated. Thresholds as follows:

Cost of living payment

The Government will provide a one-off $250 cost of living payment to help eligible recipients with higher cost of living pressures. The payment will be made in April 2022 to eligible recipients of the following payments and to concession cardholders:

Age Pension.

Disability Support Pension.

Parenting Payment.

Carer Payment.

Carer Allowance (if not in receipt of a primary income support payment).

Jobseeker Payment.

Youth Allowance.

Austudy and Abstudy Living Allowance.

Double Orphan Pension.

Special Benefit.

Farm Household Allowance.

Pensioner Concession Card holders.

Commonwealth Seniors Health Card holders.

Eligible Veterans’ Affairs payment recipients and Veteran Gold cardholders.

The payments are exempt from tax and will not count as income support for the purposes of any income support payment. A person can only receive one economic support payment, even if they are eligible under two or more categories outlined above. The payment will only be available to Australian residents

Temporary reduction in fuel excise

The Fuel excise will be decreasing by 50 per cent for a period of six months, with the exception of aviation fuels.

Business

Business Taxation Deduction boosts for small business

Two support measures were announced for small businesses (turnover under $50m) in the form of a 20 per cent uplift of the amount deductible for expenditure incurred on external training courses and digital technology.

Skills and Training Boost

An additional 20 per cent of expenditure incurred can be deducted on external training courses provided to employees in Australia or online delivered by entities registered in Australia. Exclusions apply, and the boost will apply to eligible expenditure incurred from 7:30pm AEDT on 29 March 2022 until 30 June 2024.

Technology Investment Boost

An additional 20 per cent of the cost incurred on business expenses and depreciating assets that support digital adoption can be deducted. An annual cap of $100,000 will apply in each qualifying income year, and the boost will apply to eligible expenditure incurred from 7:30pm AEDT 29 March 2022 until 30 June 2023

COVID-19 business grants designated non-assessable non-exempt income

The measure that enables payments from certain state and territory COVID-19 business support programs to be made non-assessable non-exempt (NANE) for income tax purposes until 30 June 2022 has been extended. Eligibility is limited to COVID-19 grant programs directed at supporting businesses that are the subject of a public health directive applying to a geographical area in which the businesses operate and whose operations have been significantly disrupted as a result of the public health directives.

Concessional tax treatment of carbon credit and biodiversity certificate income

The Government will allow the proceeds from the sale of Australian Carbon Credit Units (ACCUs) and biodiversity certificates generated from on-farm activities to be treated as primary production income for the purposes of the Farm Management Deposits (FMD) scheme and tax averaging from 1 July 2022.

Apprentice wage subsidy support extension

The Budget confirms the Government's earlier announcement to extend the Boosting Apprenticeship Commencement (BAC) and Completing Apprenticeship Commencements (CAC) wage subsidies by 3 months to 30 June 2022. The Budget also includes funding over five years to introduce a new Australian Apprenticeships Incentive System from 1 July 2022 as further support to employers and apprentices in "priority occupations".

Superannuation

Superannuation pension drawdowns

The Government has extended the 50 per cent reduction of the superannuation minimum drawdown requirements for account-based pensions and similar products for a future year to 30 June 2023. The 50 per cent reduction in the minimum pension drawdowns provides retirees with greater flexibility and certainty over their savings and super retirement funds.

Previously announced changes to superannuation

Removal of the $450-a-month threshold before an employee’s salary or wages count towards the superannuation guarantee.

Increasing the limit on the maximum amount of voluntary contributions made over multiple eligible financial years under the First Home Super Saver Scheme from $30,000 to $50,000.

Enabling individuals aged 60 and above to make downsizer contributions to their superannuation plan from the proceeds of selling their home, allowing up to $300,000 contribution each spouse.

Repealing the work test for individuals aged between 67 and 75 who make non-concessional and/or salary-sacrificed superannuation contributions. The work test will continue to apply for those making concessional contributions and claim a deduction for these personal contributions.

Enabling superannuation trustees to choose their preferred method of calculating exempt current pension income when they have member interests in both accumulation and retirement phases for part, but not all, of the income year

Super Guarantee rate unchanged

The Budget did not contain any change to the legislated Super Guarantee rate rise from 10 per cent to 10.5 per cent for 2022-23.

Other

First Home Guarantee Scheme: additional places announced

The Government has announced that it will expand the Home Guarantee Scheme in the 2022-23 Budget to make available up to 50,000 places each year, including 10,000 places for a new Regional Home Guarantee open to non-first home buyers. Under the expanded Scheme, the Government said it will make available: Federal Budget 2022-23

35,000 guarantees each year (up from the current 10,000), from 1 July 2022 under the First Home Guarantee, to support eligible first homebuyers to purchase a new or existing home with a deposit as low as 5 per cent

10,000 guarantees each year (from 1 October 2022 to 30 June 2025), under a new Regional Home Guarantee, to support eligible homebuyers (including non-first home buyers and permanent residents, to purchase or construct a new home in regional areas), subject to the passage of enabling legislation, and

5,000 guarantees each year (from 1 July 2022 to 30 June 2025) to expand the Family Home Guarantee to help eligible single parents with children to buy their first home or to re-enter the housing market with a deposit of as little as 2 per cent.

As always, please get in touch if we can be of assistance to you. Phone (07) 4061 1085 or email us to get started.

Hurney Partners | Your Partners.